What Does "De Minimis" Mean in Business Taxes? - The Balance

Nov 8, 2022 · The term de minimis applies in the context of business taxes and determining when employee benefits are taxable to employees as income. Learn more about what qualifies.

De minimis fringe benefits - Internal Revenue Service

In general, a de minimis benefit is one for which, considering its value and the frequency with which it is provided, is so small as to make accounting for it unreasonable or impractical. De minimis benefits are excluded under Internal Revenue Code section 132(a)(4) and include items which are not specifically excluded under other sections of ...

De Minimis Tax Rule - Overview, How to Calculate It, and Example

The de minimis tax rule is a law that governs the treatment and accounting of small market discounts. Translated “about minimal things,” the de minimis amount determines whether the market discount on a bond is taxed as capital gain or ordinary income.

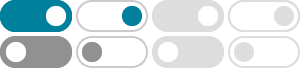

Taxable vs. De Minimis Benefits: What Employers Must Know

Nov 4, 2024 · According to the IRS, a benefit is de minimis if the value and the frequency with which it is provided is so small that it makes accounting for it unreasonable or impractical. It considers these perks as too trivial to count as income, so they remain untaxed.

What is de minimis? Meaning, uses, and real-life examples

The Latin term ‘De minimis’ means “about minimal things” and it’s all about deciding when something is too small to be worth the effort. From taxes to legal disputes, and even business audits, the concept of de minimis helps simplify decisions and cut through unnecessary details.

What is the De Minimis Rule? Definition and Explanation

The De Minimis Rule is a principle in tax law that refers to minor benefits provided by an employer to employees that are too small to merit accounting for tax purposes. These benefits are typically considered insignificant and are not subject to taxation.

De Minimis Fringe Benefits: Key Elements and Tax Effects

Aug 13, 2024 · Explore the essentials and tax implications of de minimis fringe benefits, including eligibility criteria and recent regulatory changes. Employers often seek ways to enhance employee satisfaction without incurring significant costs.

What Is the Definition of De Minimis in Business? - Indeed

Nov 4, 2024 · In business, de minimis refers to benefits that employers provide to their employees that have such little significance, and therefore they don’t need to be taxed or accounted for. The de minimis tax rule is used to determine if discounted securities get taxed at the normal income tax rate or capital gains tax rate after price appreciation.

What Is the De Minimis Rule? - TCWGlobal

The de minimis rule is a principle in tax law that allows employers to provide small, infrequent fringe benefits to employees without having to report them as taxable income. These benefits are so minor in value that it would be unreasonable or administratively impractical to account for them.

De Minimis Fringe Benefits: Meaning and examples?

Aug 24, 2023 · The term “De Minimis” originates from Latin, meaning “too trivial or minor to merit consideration.” De minimis in the context of fringe benefits means small non-cash perks given by employers, which are of such little value that accounting for them would be impractical.

- Some results have been removed